Tax laptop depreciation calculator

Before you use this tool. This depreciation calculator is for calculating the depreciation schedule of an asset.

Depreciation Rate Formula Examples How To Calculate

While all the effort has been made to make this.

. First one can choose the straight line method of. The calculator should be used as a general guide only. ATO Depreciation Rates 2021.

TaxAdda Private Limited CIN - U93000RJ2019PTC067547 GSTIN - 08AAHCT6764E1Z1. D i C R i. Cost value 10000 DV rate 30 3000.

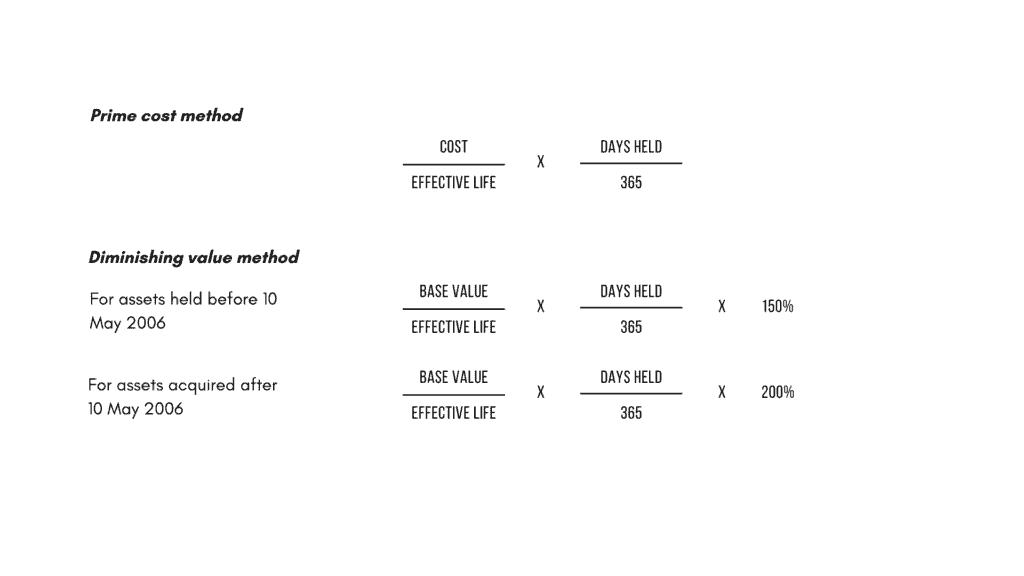

Depreciation asset cost salvage value useful life of asset. In the example 520 minus 65 equals 455. The calculation methods used include.

This depreciation calculator will determine the actual cash value of your Computers using a replacement value and a 4-year lifespan which equates to 004 annual depreciation. You can claim a one off tax deduction if the cost of the computer laptop or tablet was less than 300. Please resend the purchase document of the laptop along with the letter from the company stating that you use the laptop 100 for work purposes when sending the calculation.

Historical Investment Calculator update to 15 indices through Dec. 264 hours 52 cents 13728. Cost or adjusted tax value.

And if you want to calculate the depreciation youll also need to know the. Depreciation Calculator as per Companies Act 2013. Before you use this tool.

Calculate laptop depreciation tax Minggu 11 September 2022 Edit. The four most widely used depreciation formulaes are as listed below. It provides a couple different methods of depreciation.

If you occasionally use your mobile phone for work purposes and the total deduction youre claiming for the year is less than 50 you can claim the following flat rate amounts. The MACRS Depreciation Calculator uses the following basic formula. If you paid 10000 for a commercial espresso machine with a diminishing value rate of 30 work out the first years depreciation like this.

C is the original purchase price or basis of an asset. If it is under 300 or if any of the software you used was under 300 you. Tax depreciation is the depreciation expense claimed by a taxpayer on a tax return to compensate for the loss in the value of the tangible assets used in income-generating.

Mobileportable computers including laptop s tablets 2 years. To work out the decline in value of his desktop computer Colin elects to calculate the decline in value of his computer using the diminishing value method. Business use percentage if less than 100 depreciation method you want to use.

Further you can also file TDS returns. In the example 455 divided by three years. This Excel worksheet will calculate standard depreciation using various methods each with its own benefits and drawbacks.

Compare different assets for example the SP 500. Straight Line Depreciation Method. This tool is available to work out the depreciation of capital allowance and capital works for both individual and businesses taxpayers.

Depreciation Calculators Tax Calculations. Divide the depreciation base by the laptops useful life to calculate depreciation. Depreciation can be claimed at lower rate as per income tax act.

Ad Learn Why Financial Services Companies are Making. Where Di is the depreciation in year i. But for the next year your wdv will be considered as reduced by the percentage of depreciation prescribed.

The formula to calculate annual depreciation. Beranda Calculate depreciation laptop tax. For eg if an asset.

The tool includes updates to.

Macrs Depreciation Calculator With Formula Nerd Counter

Depreciation Formula Calculate Depreciation Expense

Top 3 Online Depreciation Calculator To Calculate Depreciation

Asset Depreciation Getting The Most Back On Your Tax Return

Methods Depreciation Guru

Macrs Depreciation Calculator With Formula Nerd Counter

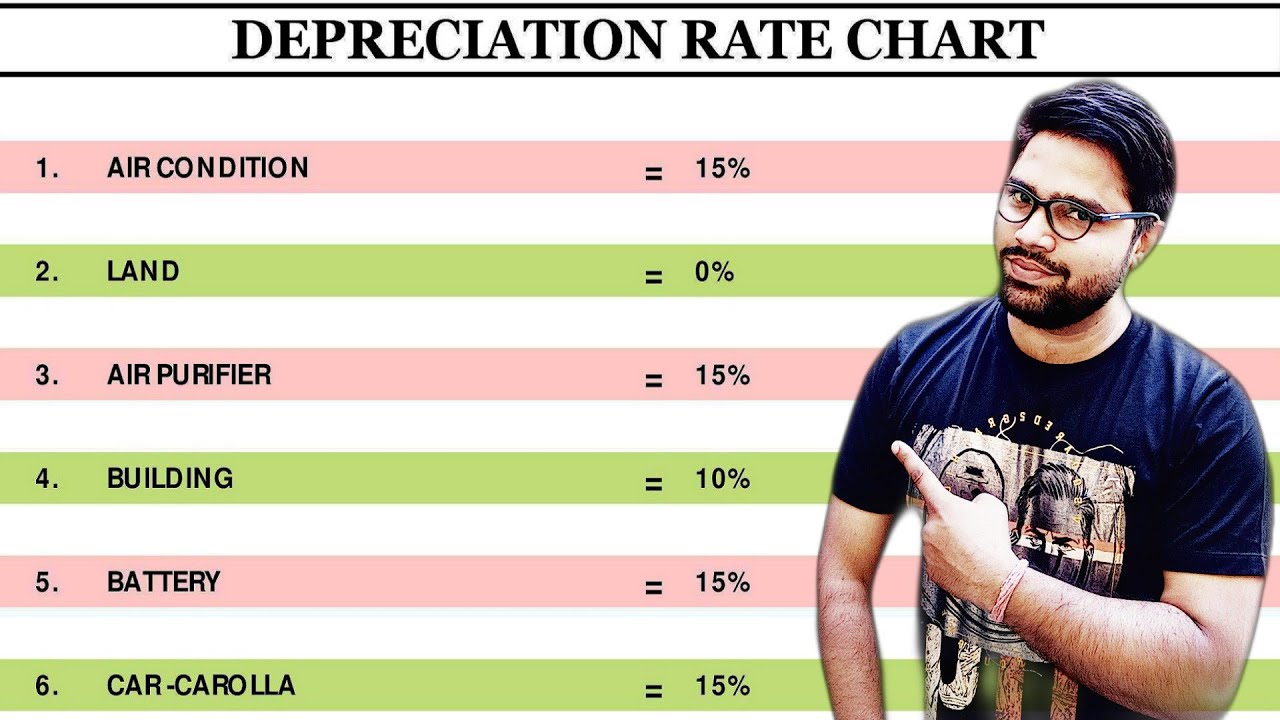

Dep Rate Chart Depreciation Depreciation Rate As Per Income Tax Rules Depreciation Rate Chart Youtube

Depreciation Rate As Per Income Tax Rules Depreciation Rate Chart Dep Rate Chart Depreciation Youtube

Macrs Depreciation Calculator With Formula Nerd Counter

Depreciation Rate Formula Examples How To Calculate

What Is The Highest Rate Of Depreciation Under Income Tax And For What Items Quora

Depreciation Formula Calculate Depreciation Expense

New Depreciation Rates Fy 2016 17 And 2017 18 Accounting Tally Taxation Tutorials

How To Calculate Depreciation

Working From Home During Covid 19 Tax Deductions Guided Investor

Depreciation Formula Calculate Depreciation Expense

What Is Straight Line Depreciation Yu Online